2020年10月9日

行業相關報導 - 2020年10月9日

1、Zara、Adidas等品牌紛紛下訂客製口罩 歐美時尚防疫大單來了 紡織巨頭學繞個彎做生意

10月中登場的台北紡織展,是全球極少數如期舉辦的「實體展」,不僅吸引來自11個國家的三百多間廠商參展,更讓超過40個品牌買主登記以視訊參與。

今年,大家最關注的焦點議題,是防疫時尚化——從口罩、防護衣、隔離衣到面罩,都開始加入顏色與設計感。因為疫情至今看不到盡頭,防疫將是未來兩、三年間,你我日常生活的一部分。

「全球消費者開始習慣與病毒共存,口罩正逐漸從防疫商品轉為配件!」紡拓會秘書長黃偉基指出,包括Gap、Zara、Puma等快時尚或運動品牌,都已著手生產搭配衣服用的布口罩,時尚防護衣的詢問度也漸增。亦即,這場新戰局將不再屬於中衛、康匠等醫療(不織布)口罩廠商,而是由儒鴻、聚陽、遠東新、旭榮、興采、廣越等紡織大廠與成衣廠拿回主場權。

時尚防護衣技術高 染劑不影響抗菌劑,成門檻

這批做慣了高單價產品的大廠,為何會投入成本約50元一片的布口罩、約200元一件的防護衣生意?故事,要從3月份說起。

當時,眾所矚目的口罩國家隊已然上路,但防護衣、隔離衣卻很可能出現缺口。於是,經濟部召集各大成衣廠組成防護衣國家隊,卻在6、7月疫情趨緩之際,遭政府砍單7成。

聊起已經投入的設備和原料,廠商們語帶無奈。但他們也指出,為了尋找政府徵收以外的出路,反而加速他們發現布口罩、時尚防護衣的潛在商機,「(這些東西)製程比成衣簡單,再繞個彎把它時尚化,又是一門生意了!」

「繞個彎把它時尚化」,說來輕巧,其實難度不低。舉例來說,隔離衣一旦染色,染料可能會和上頭的抗菌塗層互斥,影響防護效果;而布口罩雖然以機能布製作,染色或印花都不受限制,但少了醫療口罩的那層熔噴布,消費者仍會擔心,是否人多的地方就不能戴。

瞄準附加功能 大廠推涼感口罩、口罩項鍊

對此,紡織大廠們絞盡腦汁發揮獨門技術。例如,遠東新除了突破防護衣染色技術,還推出各種顏色、觸感、涼暖功能的布口罩,可單獨配戴,也可在內裡套入醫療口罩。擅長製造黏扣帶、織帶的台灣百和,則做出「口罩項鍊」,也就是一條色彩繽紛的帶子,用來扣住口罩兩端,脫下口罩時可直接掛在脖子上。

被業界公認「防護衣商機受惠最多」的興采,繞的彎就更大了。早在3月時,同業還在苦苦等待不織布釋出時,它就善用集團內擁有梭織布、防水透濕薄膜與成衣廠的優勢,將三者結合並通過P3等級醫療測試,做出以梭織布製造的防護衣。「一般防護衣原料都是不織布,沒辦法染,梭織布要染什麼顏色都可以!」興采成衣部副總經理吳燕昇笑道。

大家為何這麼拚?除了要彌補服裝銷量下滑、原料偏偏又已備齊的缺口之外,更重要的誘因,是真的有人接到大單。

最早傳出捷報的是旭榮集團。四月初,美國總統川普在一場記者會中公開稱讚內衣大廠Hans Brand,為全美民眾提供了數億個針織布口罩。業界消息指出,這批口罩的主力供應商正是旭榮,針織布出貨量約超過350萬公斤。

而興采上半年財報顯示,上半年的稅後淨利較去年同期成長九倍多,EPS更創下7.32元歷史新高,切入防護商機正是主要動能之一。

吳燕昇透露,初期客戶以醫院為主,但最近的外銷單也出現不少企業客戶,要下訂指定顏色、設計的客製化防護衣。「例如航空公司要讓空姐穿,就可以把防護衣染成企業代表色,甚至印上logo;還有運動跟戶外品牌,也希望開發新版型,例如做成像運動套裝,商務人士可以穿著登機、出差,」他說。

填產能、固客源 這場防疫戰,比的是應變力

旭榮集團執行董事黃冠華也證實這項新趨勢:「不但防疫商品開始往時尚走,時尚產品也開始往防疫走!」他指出,近期不少運動品牌的新產品開發,都不約而同強調起「防疫力」。例如,在原始的機能布材料中加入抗菌功效、褲子加入口罩收納袋、帽T可遮住口鼻等。

黃偉基分析,對擅長高單價機能服的台灣紡織廠來說,轉型做布口罩、防護衣,意義不僅是砍單後的及時雨:「更重要的是,這等於看誰能在最短時間內掌握住客戶(品牌商)的心態,呼應他們的最新需求,重新鞏固彼此關係。」

例如在美國設廠的宏遠,早在4月就呼應美國疫情,就近生產布口罩和防護衣,強化與當地政府關係;羽絨大廠廣越呼應客戶Puma、Adidas、Patagonia的需求,製作客製化logo布口罩,已連出幾批大單。而儒鴻則在經過市調後,利用機能衣技術推出除菌抑臭、透氣、涼感且添加膠原蛋白的口罩,「還沒推出,已有多家大型品牌客戶在接洽!」發言人羅仁傑說。

彈性與應變力,本是台灣的強項,這項特質,更在疫情重創歐美品牌客戶時展現得淋漓盡致。正如同前英國首相邱吉爾名言:「不要浪費任何一場危機」,防疫時尚化商機,就此揭開序幕。

資料來源:商業周刊 (2020年10月7日)

2、疫情副作用奢侈品滯銷 LVMH把庫存變業績

數以噸計的衣服準備焚燒,引發各界抗議。這樣的場景即將絕跡,身為全球最知名的奢侈品牌LVMH因應潮流,讓不見天日的衣物找到新生。

受到新冠肺炎(COVID-19)疫情影響,全世界成衣業無論是奢侈時尚或是平價快時尚,連月來顧客銳減導致許多企業關店因應,但關店只是眾多困境之一,另一項更容易引發問題的困境:庫存,導致數以噸計的衣服堆積在倉庫或者工廠。

根據美國普查局(United States Census Bureau)資料顯示,即使沒有疫情影響,美國成衣業者的庫存依舊年年上升。以往,成衣業者有2種方式來消化庫存,一是銷毀,一是折扣出清。銷毀就是切碎後送去掩埋或是焚化;折扣出清就是透過零售通路或是直營Outlet店降價促銷。

不過,銷毀的方式漸漸成為不可行,尤其在現代更會引發爭議。以格紋聞名全球的英國奢侈品牌Burberry為例,他們在2018年財務年報中揭露銷毀價值2,860萬英鎊(約新台幣11億元)的未售商品,一時輿論譁然,也令消費者不齒,Burberry隨即表示會停止銷毀的方式。

其實,早在疫情爆發前,就有國家看到這項弊端。擁有多家全球知名奢侈品牌的法國率先通過反浪費法案,禁止業者銷毀未售出但仍可使用的產品,保護的類別十分多元,除了奢侈品外,電器、衛生用品、化妝品等商品都需要重新使用或者回收。歐盟也提出相關規定,未來將適用於歐盟23個國家。

由此可知,銷毀已經不是全球主流,將產品捐做公益才是潮流新選項。以美國為例,因為大受疫情衝擊,春夏兩季服裝檔期幾乎泡湯,為了將損失降到最低,品牌業者和零售商訴諸折扣,希望增加顧客購買需求之外,假如還有庫存就捐給非營利組織。

6.6億美元商機

對於非營利機構Good360來說,它們的使命是幫助企業將多餘的商品捐贈給慈善機構,在疫情期間已經經手價值數千萬美元的成衣,全年更預計可以處理超過6.6億美元的捐贈產品,規模是去年的2倍。Good360表示,品牌業者擔心的是賣不掉的商品流入跳蚤市場,或者像Craigslist之類的免費廣告交易網站,而自家擔保不會發生這種事。

相同的顧慮也在奢侈服飾業者上發生,它們既不願將庫存品捐贈到慈善機構,也不願意走上折扣之路,最主要的原因在於擔心消費者花了十幾萬元買的名牌衣或名牌包,卻發現隔年在折扣店只要1∼2折的價格就能夠買得到。因此,奢侈服飾業者往往會聘請專人,確保未售完或瑕疵品不會流入非授權的零售通路。同時,會先將庫存設法賣給自家員工,其次則是員工的家人和朋友,假如剩下的庫存依舊無法消化,就會找專業的回收業者幫忙。

LVMH表示,已與專業回收商Nordechets合作,避免沒有賣出去的商品直接銷毀。Nordechets同樣位於法國,當收到賣出去的奢侈商品時,設立於羅亞爾河谷(Loire Valley)的工廠會先回收珠寶和貴金屬,再切碎有品牌字樣的產品,重新化身為纖維或絕緣材料。

隨著成衣業的庫存量大增,有回收產業受惠,當然也有產業遭受打擊。以英國為例,二手衣市場就飽受打擊,使得二手衣無處可去,只能走焚毀一途,成為另類受害者。英國紡織品回收協會(Textile Recycling Association)擔心,在東歐,沒賣掉的庫存衣將取代二手衣,由於疫情的關係,英國最大的二手衣外銷市場肯亞已禁止進口,只有等候疫情解除。

碳排放超標

追根究柢,當今的疫情不過是更加劇服裝業早就存在的庫存問題,也暴露這產業供應鏈高碳排放而浪費資源的問題。國際社會責任認證組織(Worldwide Responsible Accredited Production, WRAP)指出,服裝業的全球供應鏈在服裝送達消費者之前,就已經浪費了80萬噸,同時,服裝業占全球碳排放高達10%。

品牌服裝業者和零售商都不願承認的事實是-「生產太多」。零售商一次又一次地過度下單,卻希望以標籤上的原價賣出一半商品,剩下的商品就透過季末折扣來促銷。究其原因,業者之所以超收訂單,主要是因為「成本」。業者向工廠下單提高1倍,即使賣不完導致得處理多餘的產品,成本依舊不會比較多,反而可以降低成本,導致奢侈品牌與平價品牌都以此模式下單。但也因為如此,庫存量一直居高不下,瑞典快時尚品牌H&M截至4月下旬的庫存,就高達新台幣1,322億元。

疫情肆虐引發連鎖效應,實體店面在3月起陸續關閉,導致商店、配送中心和倉庫中的商品堆積如山。過去寧多勿缺的經營觀念,因為各地封城、關店,導致呈現雪崩式的惡化,業者取消、延遲訂單,或者向供應商索取折扣。生產地的工廠不堪虧損只能撙節,導致工廠員工不是留職停薪就是被裁員,成為受創最重的弱勢。但即使在這樣的情形下,多數快時尚成衣業者無意反省薄利多銷模式,也無意支付未能運抵但已經生產的商品。麥肯錫(McKinsey)對北美和西歐採購主管的調查發現,並非所有品牌都採取支持供應商的辦法。雖然有64%的受訪者承認這麼做可能讓供應商蒙受損失,卻只有19%的客戶預付訂單的款項。

零換季推動永續

消費者的環保意識高漲,服裝業推動永續性發展的進展仍然緩慢,但在這波疫情危機中,出現一絲轉變。根據麥肯錫的調查表示,45%的消費者喜歡對於疫情有貢獻的品牌,也有16%的消費者將會購買、支持社會永續的服裝。

H&M成為率先承諾付款給供應商的知名品牌之一,並表示將配合「促進建立可持續的社會保障體制」,為分擔供應商減少浪費和減碳的責任跨出一大步。Burberry也對降低庫存有所回應,宣佈今年春夏系列的多餘存貨將在Outlet折扣促銷,同時也以折扣賣給員工,接著再捐給慈善機構或者回收。美國品牌Michael Kors為了貼近顧客的生活和購物方式,宣佈每年展示和生產2個系列,採取逐步且分批上架方式,門市風格也改為簡約。

成立接近1個世紀的奢侈品牌Gucci響應了全球時尚界的500多位人士的公開信,概述加強社會責任的步驟:「我們認為,當前的環境儘管充滿挑戰,但仍提供根本而可喜的改變契機,如此可簡化我們的業務,讓經營在環境和社會上更能永續,最終也能緊密結合客戶的需求。」所以,Gucci更進一步,在2020年5月宣佈,旗下系列商品將走「不分季節」的行銷路線,以便減少生產並提昇永續發展的目標。

資料來源:https://times.hinet.net (2020年10月6日)

3、【SME學堂】虛擬消費市場潛力大 Gucci搶推「虛擬時裝」顧客更願意埋單?

你願意花 1 萬美元買一件沒無法真的穿上身的「虛擬時裝」嗎?奢侈品牌 Gucci 賭你真的會!時裝界睇準「虛擬時裝」商機,明知顧客在現實中穿不到,仍推出「數碼時裝」,這種方式反而能夠令千禧世代願意購買。

《Fast Company》報道,Gucci 即將在官方流動應用程式(app)上推出 Sneaker Garage 區塊,用戶可用平台上提供的模型設計球鞋。此外,,平台更有一對由品牌創意總監 Alessandro Michele 設計的「數碼球鞋」,用戶可用擴增實境 (AR) 功能觀看它穿在自己腳上的效果。

不過,即使顧客心動,也買不到實體版本,因為 Gucci 並沒有生產球鞋的實體版本。雖然品牌推出數碼版產品是為了刺激顧客購買實體產品的慾望,但 Gucci 這招反而令人摸不著頭腦,而事實上有人真的會購買這些虛擬產品。

Adidas 前總監 Ryan Mullins 設計了一個遊戲《Aglet》,玩家可以在上面以遊戲幣或現實金錢購買來自 Nike、香奈兒(Chanel)和巴黎世家(Balenciaga)等品牌稀有鞋款的虛擬版本,有玩家花了 15,000 美元(約港幣 116,250 元)買下多對鞋款。有外國公司亦推出虛擬時裝平台 Tribute Brand,用家可在平台上選購服飾並可以觀看服飾穿在自己身上的效果。

千禧世代成消費主力 重視數碼體驗

「虛擬時裝」雖然不能在現實中穿著,但在千禧世代(約指八、九十後)的市場有巨大的發展空間。據 2019 年精品全球消費者洞察報告(True-Luxury Global Consumer Insight)指,千禧世代將在 2025 年前主導精品消費市場。電貿推廣公司 KAMG 創辦人 Kas Andz 指,千禧世代是跟科技一起長大的,他們在屏幕前學習、歡笑,比起店內體驗,他們更重視數碼體驗。

資料來源:香港經濟日報 (2020年9月29日)

4、貿發局:今後展覽實體網上並行

【明報專訊】疫情下全球商貿活動幾陷停頓,貿發局先後舉行多次網上展覽,為中小企尋找新買家及訂單,獲得良好評價,不過仍有七成受訪買家更願參加實體展,可見傳統展覽難以取代。貿發局副總裁周啟良亦認為,全球採購模式因這次疫情漸趨數碼化,日後展覽也會以實體與網上混合模式舉行,O2O(Online To Offline)採購將會成為新趨勢。

七成買家更願參加實體展覽

周啟良直言,今年多項大型展覽均無法舉行,當中不乏亞洲甚至世界最大規模展覽,部分展覽更是行業一年一度的採購旺季,對很多中小企而言一年的生意多寡就看這麼一次。有見及此,貿發局先後透過網上形式舉行多次展覽,讓中小企能繼續與全球買家保持聯繫。

周啟良表示,將實體展覽轉戰網上其實也是且試且行,不過從早前夏季採購匯收到近千份問卷調查的回饋顯示,有七成受訪供應商認為達到了參展目的,包括擴充新客戶、接訂單和發布新產品;另有八成買家找到了適合的產品或新供應商。調查亦發現,有七成受訪買家表明,如果未來一年可以動身,都會選擇親身來港出席展覽。「從中可見,買賣雙方深度洽談,建立互信,以及部分產品需要現場體驗,這些因素都突顯實體展覽有存在的必要」周啟良道。

但同時,周啟良認為網上模式仍有獨特優勢,例如貿發局往年舉行過4次時裝展,受限於場地,每場最多只能招待1000人;上月舉行的CENTRESTAGE虛擬時裝匯演,截至9月24日,6場表演已吸引超過26萬人次網上收看。

因此,周啟良表示,就算未來恢復舉辦實體展覽,貿發局仍然會定期舉辦網上推廣,而且網上展可為實體展作進一步延伸,為供應商帶來額外機會接觸更多環球買家。再者,考慮到成本效益等因素,一些新興市場買家未必能出席實體展但能參與網上展,為貿發局招攬更多海外買家製造良機,周啟良相信,日後網上網下採購團規模只會比過去更大。

下月採購匯 參展商可免費覓商機

繼7月底的網展後,貿發局於11月舉行的秋季採購匯會再推出「商對易(Click2Match)」平台,由人工智能按資料為買賣雙方配對,再按雙方需要安排網上會議或實時聊天;此外,旗下貿發網採購平台亦會全面升級,新增不同功能。

周啟良補充,是次每名參展商既可獲貿發局資助50%參展費,餘下50%費用亦可申請政府的「中小企業市場推廣基金」報銷,參展商變相免費體驗網上展覽,又可發掘新商機。

資料來源:明報 (2020年10月7日)

5、施政報告2020|港珠澳橋放寛「南車北上」 港車免兩地牌可抵拱北

連接屯門西至港珠澳大橋香港口岸的屯門赤鱲角隧道公路,工程最快今年底完成並通車,屆時駕車來往新界西北至大嶼山的時間將大為縮短。根據去年的施政報告,政府建議當屯門赤鱲角隧道公路通車後,政府將豁免新隧道和青嶼幹線的收費,港珠澳大橋車流量會增加。

現時若本港私家車經港珠澳大橋到珠海,需要有中港車牌,並要向相關部門申請配額。據悉,政府很大機會於今年施政報告中公布,當屯門赤鱲角隧道公路通車後,所有本港私家車均可在免申請中港車牌下,駕車經港珠澳大橋到珠海,預料將大大方便兩地的交通往來,增加大橋的車流量。

有政府中人指,早於大橋通車時已預告,當連接路年底通車後,將有條件放寬現時「港車北上」的限制,容許只有香港車牌的私家車可北上珠海,但由於現時強制檢疫14日的措施仍未放寬,相信要待疫情過後才能見到相關成效。

根據資料,目前香港私家車總數量約為60多萬輛,可通行港珠澳大橋的粵港兩地車約有7.8萬輛,當中90%以上為香港車輛,而經港珠澳大橋跨界通行但不進入珠海的香港澳門單牌車輛超過9,400輛。早前有廣東省政協委員建議,從承載力角度考慮,全面開放所有港澳跨境私家車進入廣東省,對省內交通不會造成任何影響,建議全面放寬的前期階段,可先按特定配額方式進行。

事實上,現時政府未有放寬北上的車輛限制,是因擔心連接市區與赤鱲角機場的唯一連接,即青嶼幹線及青馬大橋會超出負荷,並影響居住東涌的市民日常交通來往。消息指,當屯門赤鱲角隧道公路年底開通後,青嶼幹線及青馬大橋將會一併豁免收費,由於屆時有「兩條大路通赤鱲角」,政府評估連接路的承受能力將大增,有足夠條件放寬北上車輛的限制。

料放寬檢疫措施後才見成效 陳恒鑌:有助港人北上大灣區旅遊

據悉,當有關安排正式落實,香港單牌私家車在購買第三者汽車保險後,將可經港珠澳大橋直達珠海,但只能停泊在口岸停車場,不能進入內地交通網。去年港珠澳大橋通車一周年時,運輸及房屋局局長陳帆曾表明,相信在屯門赤鱲角隧道公路開通後,大橋的車流量會增加。至於相關安排會否有配額限制,消息指需待中港兩地商討後才能公布。

有政府中人提醒,由於現時來往中港兩地的強制檢疫14日措施仍未放寬,相信要待疫情過後,才能見到成效。民建聯立法會議員陳恒鑌表示,相信有關措施可促進香港與其他大灣區城市往來,尤其吸引港人在周末駕車往大灣區旅遊,對恢復經濟有一定幫助。

資料來源:香港01 (2020年10月8日)

6、內循環新國策 免稅店大茶飯

中外經貿關係持續不明朗,惟仍有國際巨企逆勢押注中國市場。好似全球最大免稅店集團Dufry日前宣布,將夥拍阿里巴巴(09988)成立合營公司,攜手大搞中國生意。畢竟富貴險中求,在「內循環」格局下,內地免稅店行業將是大茶飯,中國政府、Dufry、阿里可望達致「三贏」,而香港及澳門「或成最大輸家」。

大家對Dufry應該不會陌生,在世界各地機場經常見到其免稅店。該集團創辦於1865年,總部位於瑞士巴塞爾,目前在全球有逾2300個據點,大部分收入來自歐洲、北美及日本市場。

阿里入股Dufry 合營拓內地

根據合作協議,阿里首先將斥資約2.5億瑞士法郎(約21億港元),認購Dufry 9.99%股權。然後雙方會在內地成立合營公司,由阿里和Dufry分別持51%和49%股權,作為Dufry在內地經營的主體,同時Dufry會把現有的內地業務注入該合營公司。換句話說,日後Dufry在中國的生意將由阿里佔大頭(51%股權),Dufry自己反而佔小頭(49%),後者似乎很「蝕底」。

但實際上,誰都知道免稅店是一種特權生意(某程度如同賭場),世界各地政府通常只准許在機場或港口關卡開設這種商店,讓旅客購買一定金額的免稅品。表面看來,這意味着政府放棄了自己的稅款收入(包括關稅、消費稅、奢侈品稅等),但同時有助把消費額「留在本地」,減少國民外遊時「血拼」的誘因。

政府保外滙 免肥水流走

舉例說,一個內地居民赴法國公幹,很可能趁機在當地購買名牌手袋及紅酒,惟若想到回程時在上海機場也可買到這些東西,而且「免稅」後比起在法國掃貨更便宜,儘管及不上當地專門店新款及齊全,卻勝在毋須「拎餐死」,所以部分人索性在上海機場花這筆錢。當局透過免稅店經營權招標獲取一些收入,再加上其創造的就業及GDP,將能局部紓緩「肥水外流」,這正是各地政府願意准許免稅店經營的原因。

有些國家基於特殊考慮,容許免稅店開設於機場及港口關卡以外地區,最典型是為振興某個偏僻地段經濟,批准在當地興建一座免稅outlet。中國政府近年把整個海南省劃為「免稅特區」,就如巨型免稅outlet,除提振該省旅遊業,亦引導民眾留在境內「買買買」。

內地早有精打細算網民計過數,現時在海南省免稅店購買名牌手袋、名錶、 化妝品,計及機票和酒店開支後,往往比來港掃貨更划算,只不過款式暫時未及本港專門店豐富。

如同賭場,容許特定地區「開賭」或對整個國家有利,放任全國各地遍布賭場則會造成反效果,故此免稅店例必受到嚴格規管,包括不可開設於市區,店舖數量及顧客消費額亦有限制,否則將令國家稅務政策形同虛設。

就像內地居民現在獲准每年在海南省購買10萬元人民幣免稅品,但必須親身赴當地出示身份證才可購買,不可網購或代購。不然的話,勢必人人都「淘寶」免稅物品,等於廢掉國家稅務政策武功。所以免稅店拓展生意的最大障礙,往往正是「地理限制」。

在「內循環」新格局下,抑制外滙流失成為中國政府迫切任務,但國民購買海外優質產品的需求不可能完全扼殺。因此內地業界普遍預期,當局勢將逐步擴大海南省的免稅政策,包括提高消費額度,並在武漢、青島、珠海等更多城市設立同類「免稅特區」。

內地居民在境內免稅店購買一個LV手袋,讓法國製造商賺取大截利潤之同時,卻起碼可省回機票、境外酒店、零售及餐飲等外滙支出。

在內地免稅店行業,目前由央企中免集團壟斷大部分市場,而該集團主要銷售茅台酒、茶葉、中藥補品等國貨;反觀Dufry身為全球最大免稅店集團,具有品牌及採購優勢,能為內地民眾提供琳琅滿目各國「平靚正」貨品。

Dufry自2008年起已進軍內地市場,惟受政策所限,現時只在上海和成都機場設有免稅店,亦未能染指海南省「免稅特區」業務。今次夥拍阿里成立的合營公司,由阿里持51%股權,可望獲中國政府勉強視為「自己人」,准許Dufry迅速擴展市場,相信此乃該國際巨擘願意只佔少數股權、這麼「蝕底」的主因。

港澳奢侈品零售恐成輸家

上文提到免稅店受阻於「地理限制」,或可透過跟阿里合作,局部突破界限,儘管未能實現「網購免稅品」,卻可嘗試「網上預購」,例如消費者1月份預購了一個限時特惠的免稅手袋,3月份再預訂一件首飾,4月份又購買了兩瓶紅酒,然後5月份親赴就近「免稅特區」一次過提貨。這樣既沒觸犯條例,又能提升買免稅品的便利程度,可說是免稅店夥拍電商的潛在商機之一。

總的而言,內地擴大免稅店政策勢在必行,Dufry與阿里今次合作有望達致「三贏」。至於香港和澳門的奢侈品零售業難免備受挑戰,面對「價廉」優勢流失,務須加強「物美」定位,並提升服務水準及相關配套,否則「自由行」這碗大茶飯恐將日漸食之無味。

資料來源:信報財經 (2020年10月7日)

7、內地「雙迴圈」非自我封閉 最終為加大開放

自內地提出「雙迴圈」這個新概念以來,各方討論一直處於高溫狀態,各種各樣的「解讀」相繼湧現。其中幾個外媒常見的觀點是「中國正在將自己封閉」、「中國外匯儲備會因此大幅下降」、「雙迴圈就是內迴圈,不再看好外資、不再推動出口」等等。

外媒「誤讀」 違內地當前政策走向

如此種種,若簡單聽之,似乎有些許道理,但其實明晰事理或有經濟學常識的人都知道,上述解讀是對「雙迴圈」的誤讀,不但不符合經濟基本規律,亦與內地當前真實政策走向有悖。若誤讀被放大,不但不利於各地自身經濟發展,對於以外貿謀生或正在做投資決策的人來說,理解錯誤等於搬起石頭砸自己的腳。那麼,真相究竟是什麼?這需要條分縷析。

不少觀點認為,內地提出雙迴圈是形勢所逼。因為中美貿易形勢讓世界第一、第二大經濟體逐漸「互相關門」,「小弟們」也相應呼應,四面圍堵之下,不得已以「雙迴圈」之名,行「內迴圈」之實。

其實不然。筆者以為,提出以國內大循環為主體,國內國際雙迴圈相互促進,並不是為了應對新冠病毒疫情或是中美貿易摩擦才採取的短期措施。本身,內地對出口的依仗近幾年已經大幅縮水,出口佔GDP的比重已經從2006年的35.4%降至2019年的17.4%。意即,去年中國產值的82.6%是在通過國內自己實現的。

這個比例,其實與美國、日本、歐洲等經濟體的基本相當。隨着經濟發展達到一定水準,服務業在一國經濟中佔比會迅速提高,而服務業很多是「不可貿易」的,因此不少高收入國家中出口佔GDP比重愈來愈小。當下,中國前所未有重視服務業,提出「以國內大循環為主體」,與國際規律是相符的,並非特例,亦非形勢所逼的短期之舉。

雙迴圈就是內迴圈,意味着內地正在將自己封閉?當然也不是。筆者認為,雙迴圈的本質,是走向更加有深度和廣度的開放。舉一個簡單的例子,內地近期決定增設多個自貿區,這就是以內迴圈促進外迴圈的一個重要形式。

內地經濟中存在的問題,不是沒有需求或需求不足,而是有效供給不足,大量「需求外溢」,消費外流。自貿區的設立,可以把產品、產業、企業、技術、平台聚合,為國內大循環清障,打通關節,最終還是為了加大開放。

增設多個自貿區 為國內大循環清障

此外,在發展水準有差異的產業和地區,通過內迴圈也可以讓各種生產要素更自由流動,從而帶動外迴圈,所以內外迴圈是相互促進、相互強化的,並非自我封閉。經濟要發展好,離不開國內和國際兩個市場,兩種資源。在內地經濟已經高速度發展了40餘年的當下,民眾收入水準提高,服務業比重擴大,出口佔國內經濟的比重一定會下降,但這種結構的變化反映的是經濟的基本規律,並不是政策方向的改變。

資料來源:明報 (2020年10月4日)

8、馬雲:傳統工業時代的全球化正終結 真正的數字時代全球化剛開始

阿里巴巴 (09988) 創辦人馬雲認為,2020年非常特殊,未來一定是一個歷史的分水嶺。「今天是真正的全球化開始的時候,今天是昨天的、原來的、傳統的工業時代的全球化正在終結,新的真正的數字時代的全球化才剛剛開始。」

馬雲在2020中國綠公司年會上表示,疫情後該考慮如何讓經濟重生,經濟重生不是為了回到昨天、回到以前,而是達到更高水平,從疫情中看到未來和趨勢,把握機會,世界格局在過去兩年發生了巨大變化,這時候堅持全球化比任何時候都重要。

國際化和全球化是兩個不同的概念

「國際化和全球化是兩個不同的概念。國際化更偏向於中國人跟外國人做生意,是雙邊為主。全球化是世界各國的大事情,世界國與國之間,是一個全局的問題。」

馬雲認為,以前全球化是發達國家和大企業主導,未來全球化應該是發展中國家的中小企業走向世界。以前貿易是全球化的主力,未來科技將是全球化的主力。以前是人在流動、貨在流動,未來是數據在流動,服務在流動。以前是傳統企業的全球化,未來是用好互聯網技術的互聯網技術的全球化。

「未來任何一個人只要有一部手機就可以做全球的生意,未來所有的中小企業都必須是跨國公司。」

馬雲指,新一輪的全球化,將由中國內需驅動,中國將會從「賣賣賣」變成「買買買」,而中國每一次大門打開都是進步的象徵。

新的全球化是一種服務世界的能力

新的全球化是一種服務世界的能力。如果說過去中國「走出去」必須是要人走出去、機器走出去、資金走出去,今天的中國「走出去」需要信息走出去、服務走出去、價值走出去。「全球化是一種服務世界的能力,不是賺世界錢的能力。中國企業應當堅定地走向全球,而不是去征服全球。」

談及數字化升級,馬雲表示,在今天所有巨大的不確定當中,數字化是確定的,數字化一定會全面地改造所有的行業,不是每個企業都要轉型,但每個企業都必須完成數字化升級。所有的企業今天一定要思考,要利用數據化來進行升級自己的管理,升級自己的組織,升級自己的產品。「未來十年是傳統企業數字化的最後十年。」

新型冠狀病毒恐怕會比誰都活得長

馬雲相信,疫情總會結束,但是新型冠狀病毒或會伴隨人類幾百年甚至上千年,恐怕會比誰都活得長,因此要學會適應,防疫也要學會從常規防疫變成常態防疫,也許以後絕大部分的醫院都有個新冠科,長期共存這是基本出現的情況。

馬雲:中國企業應走向而非征服全球 「要贏回來尊重」

阿里巴巴(09988)創辦人馬雲周二(29日)表示,新的全球化是一種服務世界的能力,不是賺世界錢的能力,中國企業應當堅定地走向全球,而不是去征服全球;走出去不僅要贏來利潤,也應贏回來尊重。

馬雲出席2020中國綠公司年會時稱,美國3億人的消費驅動上一輪的全球化,但中國14億人內需會驅動下一輪真正的全球化,從而帶動世界經濟。他表示,應該對美國過去帶動的全球化表示感謝、感恩,「但是我們今天需要的是更大的擔當」。

感謝美國帶動全球化 「中國14億人內需驅動下輪全球化」

他認為,新一輪的全球化中國將會從「賣賣賣」變成「買買買」,但強調進口不是終點,最終要倒逼國內產業、消費升級,促進現代服務業的發展。未來的機會在於中國百萬人口的小城鎮,這些城市將來或會有300個,有巨大消費潛力。

他又提到,新的全球化是一種服務世界的能力,核心是在其他國家和地區創造價值、就業,做當地做不到的事情。他續稱,如果說過去中國「走出去」必須是要人、機器、資金走出去,今天的中國「走出去」需要信息、服務、價值走出去。

馬雲指出,中國企業應當堅定地走向全球,而不是去征服全球。他說,很多人爬山認為是征服自然,但自然不是去征服,自然是去臣服;對世界真正的價值,不是遠征,而是去創造價值。

「我們走出去要贏回來的不僅僅是利潤,而應該贏回來的是尊重。我們要展示的不是一個強大的國家,而是一個善良、美好的國家。」他說,不要想去轉移過剩產能,而是要到當地去創造價值,尊重當地文化、價值觀、宗教和信仰,尊重每個國家不同機制和體制。

資料來源:香港經濟日報 (2020年9月30日)

9、17 retailers that could go bankrupt as the COVID-19 era wears on

The industry is approaching a record for filings this year, and others are still vulnerable as the economy, pandemic and retail evolution take their toll.

Retail bankruptcies may hit a painful high-water mark in 2020. Multiple analysts have noted filings are likely to reach their highest number in a decade. Some weeks during the summer brought multiple filings by major names in the industry.

In a kind of chorus, the cohort of filers have pointed to the tribulations brought by COVID-19 in explaining their predicaments, citing massive revenue drops from store closures, pressure from landlords, and white-hot cash burn.

Many of them, though, entered the year in a vulnerable state and may have filed anyway. Filings have been elevated since 2016, when declines in mall traffic, e-commerce penetration, market share theft by discounters and mass merchants, and a host of other issues began combining to tip into Chapter 11 those retailers with the highest debt levels and worst sales trends.

Some of the biggest names to enter Chapter 11 this year have made numerous appearances on Retail Dive's past bankruptcy watch lists. That includes J. Crew and Neiman Marcus, which, until they filed, appeared on every past watch list Retail Dive has published since it began doing so in the summer of 2017. J.C. Penney, one of the largest bankruptcies this year in terms of company revenue, has appeared on every watch list since 2018.

Companies with stressed balance sheets and poor sales trends came into 2020 with little room for error and then got clobbered by a massive, unprecedented event, one that took its toll even on relatively healthy companies.

Nor is the bloodletting over. Bankruptcies have largely slowed as the industry heads into the holiday season. But depending how the holidays shake out, 2021 could bring another wave.

Meanwhile, consumers continue to shift their shopping habits as the pandemic wears on. Foot traffic is still depressed in many sectors, especially mall-based retail. Supply chains have gone through tremendous financial stress along with retail. More consumers have been shopping online than ever. Target and Walmart have seen large sales and market share gains as they lean on the combination of digital platforms and stores. Federal stimulus measures that helped prop up the economy and retail sales in the spring and summer have run out.

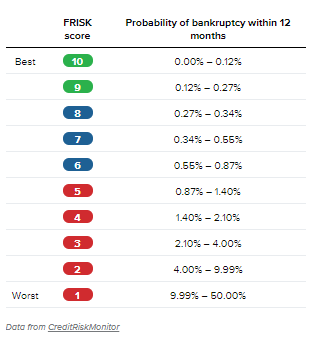

According to data provided by CreditRiskMonitor, 17 companies are at heightened risk of filing for bankruptcy in the next 12 months. As of Sept. 29, eight retail companies had a FRISK score of 1, indicating the highest risk, with an estimated 10% to 50% chance of filing for bankruptcy.

More than half of those have seen their FRISK scores drop to the riskiest level since March, among them Express and Chico's (with the largest drops in FRISK scores) as well as Francesca's, Destination XL and iMedia Brands.

Another nine retailers had FRISK scores of 2, with a 4% to 10% chance of bankruptcy. Those scores are based on credit ratings, stock volatility, financial metrics and proprietary data around the use of CreditRiskMonitor's platform. Among them, Vince, L Brands, Christopher & Banks, Children's Place, Caleres and Designer Brands all saw their scores drop to a 2 since the COVID-19 crisis began. Express, Chico's and Francesca's all dropped from scores of 3 or 4 to 1 in the same period.

Because FRISK scores only cover publicly traded companies, they don't cover the full universe of retail and potential risk. Among private retailers rated by Moody's not listed above, six carry a C-level rating indicating high default risk: Joann, Belk, NMG Holding Company (the reorganized Neiman Marcus), 99 Cents Only, Petco and Guitar Center. There are still other major retailers at risk not captured by that data either.

J. Jill

Apparel seller J. Jill has already dodged bankruptcy once this year. In the spring, when the COVID-19 closures hit industry revenue like a meteor, J. Jill joined the retailers issuing "going concern" warnings, accounting language that signals to investors they might not be able to remain solvent. That disclosure represented a breach of J. Jill's loan terms, forcing it into forbearance with lenders.

After numerous forbearance extensions, J. Jill produced a deal that would extend debt maturities and boost its liquidity. Without enough support for the agreement, J. Jill would have had to file for Chapter 11, the company said. Later, in mid-September, it announced that it had enough support among its lending base to complete the out-of-court deal.

The company still has an uphill climb ahead of it. In the second quarter, J. Jill's sales were down nearly 50% year over year. What's more, J. Jill had problems going into the pandemic. In 2019, the retailer posted a comparable sales decline of 3.6% and net loss of $128.6 million.

Party City

Graduations, weddings, birthdays, sports celebrations — cancelled. COVID-19 not only forced Party City to close its stores this spring, it also attacked the very heart of its business: social gatherings.

As with most others with heightened risk scores, Party City's problems started well before the pandemic. Comparable sales in 2019 fell 3% as the retailer racked up a loss of more than half a billion dollars. It is also saddled with some $1.7 billion in debt, a hangover from a previous private equity buyout.

The pandemic has exacerbated all of the retailer's woes. Even as BOPIS sales exploded by 500% in May, the retailer's overall sales were still down by 19%. The company has bought itself some time with a debt deal in June that extended maturities and eased its balance sheet.

But it still has a tough road ahead. Halloween, which accounts for 20% of Party City's retail sales and was a "disaster" for it in 2019, is fragmented this year amid the pandemic. Party City plans to open less than a tenth of the pop-up Halloween City stores that it did last year, though it's boosting staff at individual stores to support omnichannel services.

L Brands

As profits turned negative at L Brands last year, executives unveiled a plan to revive Victoria's Secret. A few months later, the company planned to unload a majority stake in the lingerie giant to private equity firm Sycamore Partners as CEO Lex Wexner announced he would step down.

And then the pandemic upended the deal, which would have brought in cash and freed the company to focus on its successful Bath & Body Works banner. L Brands is once again stuck with a massive brand in decline as competitors ascend and Victoria's Secret's sexualized marketing loses traction. As L Brands tries to manage that decline, it has said it will close 250 Victoria's Secret stores this year.

During the shutdown period, the company, like many others in retail, took on hundreds of millions of dollars in new debt after it drew down its revolver and issued new bonds in an effort to raise cash with stores closed. Since then, though, L Brands has also bought back some of its outstanding bonds due to mature in the coming years to take some debt off its balance sheet.

Francesca's

In June, women's apparel retailer Francesca's disclosed to investors that it might have to file for bankruptcy if it runs into financing constraints. That followed a "going concern" disclosure that warned about its ability to survive as a business.

Survival is tough for apparel retailers right now. Mall traffic remains well below last year's levels, which were already then — in a growing economy — troubled. Francesca's, with a relatively large store portfolio, has struggled in that environment. Last year, the company moved to close stores and its chairman departed as its stock price plummeted on continued sales declines and profit losses.

COVID-19 only made things harder. In the second quarter, even after most stores reopened, sales were down by nearly 30% and the company was still generating profit losses from its operations. Executives said that they are exploring strategic alternatives, which could include debt restructuring.

Chico's

Like Francesca's, Chico's has struggled in the world of mall-based apparel. Sales have been on a steady decline since 2015, and profits turned negative last year. In 2019, the retailer announced it would close 250 stores in an effort to refocus around omnichannel.

This year has brought even deeper difficulties. By Q2, sales had improved from the period before, which included the pandemic closures, but still remained down nearly 40% from the year before.

The retailer has named a new CEO and moved to slash costs as it tries to navigate the COVID-19 era. In August, the retailer's Canadian arm filed for bankruptcy after its stores in the country never reopened.

Some analysts, though, see hope for the retailer, which also runs the White House Black Market, Soma and TellTale brands. "We anticipate performance to start to meaningfully improve as consumers start returning to stores or moving to online purchases due to pent-up demand," B. Riley FBR analyst Susan Anderson said after Q2 in an emailed note. "We also believe the shift to more comfortable and versatile assortment will help entice the CHS consumer to spend."

Source: www.retaildive.com (8 Oct 2020)

10、H&M Brings Garment-to-Garment Recycling to the People

H&M wants its customers to see how old clothes can be transformed into new.

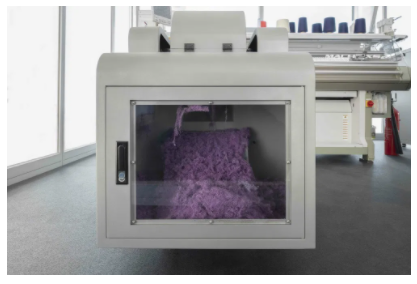

On Oct. 12, the Swedish retailer will launch Looop, a container-sized garment-to-garment recycling system that will debut in one of its Drottninggatan stores in Stockholm, where it will mechanically shred castoffs into fibers, spin them into new yarn and then reknit them into “new fashion finds.”

Part of a partnership with the Hong Kong Research Institute of Textiles and Apparel (HKRITA) and Hong Kong-based yarn spinner Novetex Textiles, the system is similar to a setup that rolled out in the Tsuen Wan neighborhood of Hong Kong in 2018. Like its predecessor, Looop uses no water or chemicals, making the process of remaking garments less of a strain on the environment than creating clothing from scratch. Some virgin material is still needed, but H&M says it will work to make this share “as small as possible.”

For 100 Swedish kronor ($11.26), members of the retailer’s loyalty club can watch Looop turn “their old garment into a new favorite.” For non-members, the price is 150 Swedish kronor ($16.89). All proceeds will benefit projects related to research on creating more circular materials. H&M did not specify how long customers will have to wait for their new threads, but the Hong Kong system was able to recreate looks in as little as four hours.

As a stand-alone structure that is only nominally pegged to any scaled-up program, Looop, in its current form anyway, is more theater than strategy, and one that would be hard-pressed to keep up with the 29,005 tons of textiles H&M collected in 2019 through its take-back program. But the retailer says it’s part of a bigger ambition to become “fully circular and climate positive.” By 2030, H&M aims for all its materials to be either recycled or more sustainably sourced. The figure, as of 2019, stands at 57 percent.

H&M Foundation, the company’s charitable arm, has also provided funding for HKRITA’s efforts to solve one of textile recycling’s biggest challenges: how to tease apart post-consumer cotton-and-polyester-blended fabrics and recover their constituent components. That technique uses heat, water and less than 5 percent of “biodegradable green chemicals” to degrade the cotton fibers into cellulose powder and separate them from the entangled polyester.

“We are constantly exploring new technology and innovations to help transform the fashion industry as we are working to reduce the dependency on virgin resources,” Pascal Brun, head of sustainability at H&M, said in statement. “Getting customers on board is key to achieve real change and we are so excited to see what Looop will inspire.”

On Oct. 12, Swedish retailer Hennes and Mauritz will launch Looop, a container-sized garment-to-garment recycling system with HKRITA.

H&M, perhaps in response to criticisms about the profligacy of so-called fast fashion, has doubled down on textile recycling, investing heavily in startups like Re:newcell and Infinited Fiber in its quest to crack the code on waste and shrink its virgin footprint. Because of the limitations of mechanical recycling, only 1 percent of all clothing is currently recycled into new ones, according to the Ellen MacArthur Foundation. Brands looking to boost their eco bonafides are betting on green-chemistry firms, however nascent, to eventually fill the breach.

“We must innovate materials and processes while inspiring customers to keep their garments in use for as long as possible,” Brun said.

Source: www.sourcingjournal.com (8 Oct 2020)

11、Marks & Spencer to Bring Back Clothes Recycling ‘Shwopping’ Scheme

Sustainable practices that were put on pause due to the Covid crisis are seeing a resurgence.

Just ask Marks & Spencer, which is relaunching its popular “Shwopping” clothing recycling program after months of inactivity. On Oct. 1, the British retailer will revive the 12-year-old upcycling and resale scheme after shutting it down in March amid the retail lockdown.

Shwopping has found a new home or use for 35 million clothing items since its inception, M&S says. Apparel is donated through bins at 287 of the company’s retail stores and sent to charitable collective Oxfam, which brings together more than 20 global charities in an effort to alleviate poverty.

The charity resells the clothing in one of its shops or on the web, while some donations are sent to its social enterprise in Senegal. Unsalable merchandise is sent to M&S’s Wastesaver facility to be recycled into new materials, like filling for mattresses. Since 2008, Shwopping has raised 23 million pounds ($29.5 million).

The company’s decision to stop accepting donations this spring stemmed from a need to focus on enacting safety measures across its store locations. And like most retailers, M&S has faced hardship because of declining foot traffic. In August, the retailer announced that it would be slashing about 7,000 jobs over the ensuing three months, in addition to the 950 positions eliminated earlier this year.

But as U.K. shoppers have spent more time holed up at home, many have become desperate to clear their wardrobes of unwanted shoes, apparel and accessories.

“At M&S, our goal is to source all our products with care and ensure nothing we make goes to waste,” said Carmel McQuaid, head of sustainable business for the British chain. “We want our customers to be confident that the clothes they buy at M&S are made to last, but if they finish wearing their old favorites, we make it easy to give them a new purpose through Shwopping.”

The effort should prove particularly timely for shoppers who have been anxious to declutter their closets, McQuaid added.

Fee Gilfeather, head of audience and strategic planning at Oxfam, said the program was designed as a simple solution for customers and the general public to donate unwanted garments, and that Shwopping “helps to extend the lifecycle of clothes and reduce the number of items of clothing going to landfill.”

“The return of Shwop drops to M&S stores means that there are more ways for people to donate to Oxfam and support our work fighting poverty and helping vulnerable communities around the world,” she said.

The pandemic has forced the program’s evolution, however, and new processes have been put in place to ensure the safety of those who come in contact with the garments and accessories. All items donated through M&S stores will be quarantined for 48 hours before being sent to Oxfam to lessen any risks of infection.

The retailer has also taken steps to support a more sustainable shopping journey online. M&S has begun including details about the eco-friendly raw materials it uses on its product pages, totaling 4,000 so far, and touts itself as the first major U.K. retailer to publish information about each of its factory partners, available through a web-based interactive map.

Shoppers also have an opportunity to make a donation to one of the retailer’s charity partners—including Stephen Lawrence Charitable Trust, Breast Cancer Now, and NHS Charities Together—each time they check out online. The M&S distribution center in Leicestershire is powered fully by renewable energy—one-quarter of which comes from solar panels on its roof.

Products are shipped in bags made from recycled plastic, which can be recycled at any of the company’s stores, and the company is phasing out paper delivery slips in an effort to save 140 tons of paper each year.

Source: www.sourcingjournal.com (29 Sep 2020)

12、Bangladesh Garment Sector Still Not Out of the Woods, Experts Say

As the Covid-19 pandemic continues to grip the globe and throttle supply chains, garment workers in Bangladesh are still bearing the brunt of an industry-wide slowdown that has left thousands struggling to find work and floundering on the brink of destitution.

More than 70,000 people are estimated to have been laid off after predominantly Western brand and retailers suspended or rescinded $3.1 billion worth of clothing orders and recent rebounds in textile exports have not been able to make up for the anticipated $5 billion in fiscal-year losses, according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), the country’s largest trade group of garment factory owners.

Though factory chiefs say 90 percent of canceled orders have been reinstated, and production lines are hiring again, labor advocates say demand for jobs far surpass supply, leaving jobless garment workers with few alternatives or assistance. Workers have had to leave the manufacturing center of Dhaka and return to their villages, where they rely on food handouts from local charities.

“For every 10 workers who lost their jobs, only one is being hired,” Kalpona Akter, founder of the Bangladesh Centre for Worker Solidarity, told the Thomson Reuters Foundation Friday. “This is putting the lives of thousands of workers and their families at risk, because they haven’t earned for the last three to four months.”

Though the industry exhibited recent signs of recovery—Export Promotion Bureau data showed Monday that shipments of ready-made clothing topped $8.13 billion from July to September—factory owners say orders are still down by two-thirds and brands are demanding discounts of 20 percent to 25 percent for previous orders.

“The turnaround hasn’t been significant,” said Mohammad Hatem, vice-president of the Bangladesh Knitwear Manufacturers and Exporters Association, which represents about 800 factories, told the Thomson Reuters Foundation. “We thought we would get a good number of orders before Christmas, but that hasn’t happened.”

Even in the first 25 days of September, prices have declined by 5.29 percent compared to the same time last year, Rubana Huq, president of the BGMEA, told Sourcing Journal. “All these would not certainly leave the factories in a better position to do good for [their] workers,” she said, though she called 70,000 workers “not a significant part” of the total workforce. While Huq does not expect the employment situation to get worse, since exports are leveling off from its prior nosedive, she would like to see greater emphasis given to “sourcing, pricing, payment and bankruptcy protection” to better prop up factories and those they hire.

Indeed, a study published last week by Brac University’s Centre for Entrepreneurship Development, the James P. Grant School of Public Health and the Subir and Malini Chowdhury Center for Bangladesh Studies at the University of California, Berkeley, found that 82 percent of the 1,057 Bangladeshi garment workers it surveyed earned less in April and May compared with February because of Covid-19’s economic fallout and a nationwide lockdown that saw workers earning—at most—65 percent of their established wages. Some 52 percent of respondents said they saved less in April and May compared with February; 77 percent said it was difficult feeding everyone in their household. Three in five workers said they were likely or very likely to get infected by the virus at their workplaces and 29 percent said they would probably contract it from their homes.

As of Monday, Bangladesh has reported more than 370,000 confirmed cases of Covid-19 and at least 5,300 deaths.

Huq says the industry needs to take a holistic view about worker concerns. “We should not also deny the fact that the factories were completely left abandoned that time by the buyers,” she said. “With no payments coming for the goods that were already shipped, with confirmed orders in different stages being stranded for several months, probably the steps taken were the best we could do to save the workers and the industry.”

“We are extremely grateful to [the] Honorable Prime Minister of Bangladesh for the great support provided to the industry through wage support loan and working capital loan which ultimately helped the industry pay the workers and keep the businesses going,” she added, referring to the Bangladeshi government’s regular disbursements to export-related industries to help pay wages and its 1-trillion-taka ($11.8 billion) nationwide stimulus package.

The authors of the Brac University report wrote that the existing sector may need an overhaul. Bangladeshi garment workers, in order to be treated with dignity, they said, need a system where they have a “safety net, adequate wages and job security.

“These are all necessary for workers’ livelihoods during normal times, but even more critical during times of extreme economic crisis and hardship, like under this current pandemic,” the authors said. “Otherwise, as we see, it is very difficult to mitigate a crisis by living hand to mouth (with inadequate nutritional intake), reducing other potential critical expenses and exhausting limited savings. All these actions have placed workers in an extremely unhealthy and vulnerable situation. We need to have a continued discussion around the adequacy of current wages.”

The garment sector, which employs 4.1 million workers and is the second-largest exporter of clothing after China, generated $34.1 billion or 84 percent of the Bangladesh’s overall exports in the fiscal year through June 2019.

Source: www.sourcingjournal.com (6 Oct 2020)

13、Vietnam Tariff Threat Sparks AAFA Outcry

Fashion isn’t thrilled at the growing prospect of tariffs on goods out of Vietnam, a major sourcing destination for footwear and apparel.

A move by the U.S. Trade Representative (USTR) to launch a Section 301 investigation on Vietnam, which could open the door to imposition of punitive tariffs on U.S. imports from the country, drove the American Apparel & Footwear Association (AAFA) to urge the government to “refrain from sowing further supply chain disruption” during the Covid-19 pandemic.

Late Friday, USTR said it was initiating an investigation at the direction of President Trump addressing two significant issues with respect to Vietnam. USTR will investigate Vietnam’s acts, policies and practices related to the import and use of timber that is illegally harvested or traded, and will investigate Vietnam’s acts, policies, and practices that may undervalue its currency and thus damage U.S. commerce.

USTR said it will conduct the investigation under Section 301 of the 1974 Trade Act, the same action that resulted in a trade war with China over the past two years and resulted in steep tariffs levied on a wide range of goods, including apparel, textiles and footwear, between the two countries. As part of its investigation on currency undervaluation, USTR said it will consult with the Department of the Treasury on issues of currency valuation and exchange rate policy.

“Vietnam is an important trading partner for the U.S. apparel, footwear and travel goods industry, and has become even more important as U.S. companies have implemented diversification strategies away from China,” said Steve Lamar, AAFA president and CEO. “As brands did their best to restructure their sourcing models to protect American consumers and American global value chain workers from increased costs caused by the administration’s tariffs, and follow the administration’s edict to diversify from China, many turned to their trusted partners in Vietnam.

“Imposing new punitive tariffs on imports from Vietnam would cause extreme disruption, directly threatening those investments and increasing prices for hard-working American families at the register or costs on the supply chains that directly support millions of U.S. jobs,” he added.

USTR Robert E. Lighthizer said the government charged Vietnam with using illegal timber in wood products exported to the U.S. market that harms the environment and is unfair to U.S. workers and businesses who use legally harvested timber.

“In addition, unfair currency practices can harm U.S. workers and businesses that compete with Vietnamese products that may be artificially lower-priced because of currency undervaluation,” Lighthizer said. “We will carefully review the results of the investigation and determine what, if any, actions it may be appropriate to take.”

However, Lamar said this is not the time to impose new costs on U.S. supply chains, particularly on job creators still recovering from the impacts of the coronavirus pandemic.

“Further, new punitive tariffs could make it even harder to source the personal protective equipment that our communities need to safely regrow the economy,” he said. “Tariffs are taxes on American consumers and American workers. It is time for the administration to take a different approach to trade policy, one that does not punish American consumers, American workers, and the American communities they support.”

Vietnam is the second-largest supplier of apparel, footwear, and travel goods to the U.S. market, and has experienced dramatic growth since 2016. For the year to date through July, U.S. companies imported $6.94 billion worth of apparel from Vietnam, a, 11.06 percent decrease compared to the same period in 2019. During the same time, Vietnam’s footwear shipments were down 8.6 percent to $3.62 billion.

USTR said it will issue two separate Federal Register notices this week that will provide details of the investigation and information on how members of the public can provide their views through written submissions.

Source: www.sourcingjournal.com (5 Oct 2020)